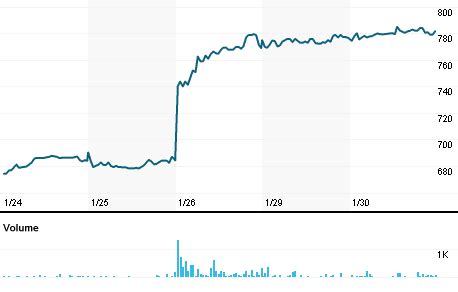

lvmh p/e LVMH Moet Hennessy Louis Vuitton's latest twelve months p/e ratio is 22.5x. LVMH Moet Hennessy Louis Vuitton's p/e ratio for fiscal years ending December 2019 to 2023 averaged .

5 spots. Free 2 hours. 60 + min. to destination. Find parking costs, opening hours and a parking map of all 111 S 4th St parking lots, street parking, parking meters and private garages.

0 · where is lvmh listed

1 · lvmh ticker symbol

2 · lvmh stock price today

3 · lvmh stock forecast

4 · lvmh share price chart

5 · lvmh moët hennessy

6 · lvmh moet hennessy louis vui

7 · louis vuitton ticker

›. Hombres. ›. Accesorios. ›. Gafas y Accesorios. ›. Lentes de Sol. Visita la tienda de Levi's. Levi's Lentes de sol rectangulares Lv 5013/Cs para hombre. 3.3 15 calificaciones. US$5851. Devoluciones GRATUITAS. Ancho de la lente: 53 Milímetros. Color: Negro - Detalles del producto. Origen. Importado. País de origen. China. Acerca de este artículo.

According to LVMH 's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 24.3645. At the end of 2021 the company had a P/E ratio of 29.1. Oct 28, 2024 Find the latest LVMH Moët Hennessy - Louis Vuitton, Société Européenne (MC.PA) stock quote, history, news and other vital information to help you with your stock trading and investing. The p/e ratio for LVMH Moet Hennessy Louis Vuitton (LVMUY) stock is 22.10 as of Thursday, October 31 2024. It's improved by -8.28% from its 12-month average of 24.10. .

where is lvmh listed

lvmh ticker symbol

The PE Ratio (TTM), or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to its Earnings per Share (Diluted). As of today (2024-11 .LVMH Moet Hennessy Louis Vuitton's latest twelve months p/e ratio is 22.5x. LVMH Moet Hennessy Louis Vuitton's p/e ratio for fiscal years ending December 2019 to 2023 averaged . A stock with a P/E ratio of 20, for example, is said to be trading at 20 times its trailing twelve months earnings. In general, a lower number or multiple is usually considered better .

The p/e ratio (diluted eps) for LVMH Moet Hennessy Louis Vuitton (LVMUY) stock is 24.12 for the period ending in Jun 30, 2024. That's down 100.00 from the same period last year.

In depth view into Lvmh Moet Hennessy Louis Vuitton Operating PE Ratio including historical data from 2008, charts and stats. Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 131.70 -0.89 ( . View LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) current and estimated P/E ratio data provided by Seeking Alpha. The PE Ratio as of November 2024 (TTM) for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) is 21.77. According to LVMH Moët Hennessy - Louis Vuitton, Société Européenne’s latest financial reports and current stock price.The company's current PE Ratio is 21.77.This represents a change of 74.26% compared to the average of .

omega speedmaster replica

lvmh stock price today

how can you tell if a rolex is vintage

Therefore, lower-P/E stocks are more attractive than higher P/E stocks so long as the PE ratio is positive. Also for stocks with the same PE ratio, the one with faster growth business is more attractive. Lvmh Moet Hennessy Louis Vuitton SE stock (LVMHF) PE ratio as of Sep 13 2024 is 22.27. More Details Competitive Comparison of Lvmh Moet Hennessy Louis Vuitton SE's Forward PE Ratio. For the Luxury Goods subindustry, Lvmh Moet Hennessy Louis Vuitton SE's Forward PE Ratio, along with its competitors' market caps and Forward PE Ratio data, can be viewed below: * Competitive companies are chosen from companies within the same industry, with .LVMH Moët Hennessy - Louis Vuitton Société Européenne's p/e ratio (fwd) is 22.5x.. View LVMH Moët Hennessy - Louis Vuitton, Société Européenne's P/E Ratio (Fwd) trends, charts, and more.Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 29.9 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 24.2333.At the end of 2021 the company had a P/E ratio of 29.9.

What is Lvmh Moet Hennessy Louis Vuitton SE PE Ratio? The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to its Earnings per Share (Diluted).As of today (2024-11-02), Lvmh Moet Hennessy Louis Vuitton SE's share price is 9.88.Lvmh Moet Hennessy Louis Vuitton SE's Earnings per Share (Diluted) .

What is Lvmh Moet Hennessy Louis Vuitton SE PE Ratio? The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to its Earnings per Share (Diluted).As of today (2024-10-30), Lvmh Moet Hennessy Louis Vuitton SE's share price is 3.93.Lvmh Moet Hennessy Louis Vuitton SE's Earnings per Share (Diluted) .LVMH Moet Hennessy Louis Vuitton's latest twelve months p/e ratio is 24.3x.. View LVMH Moet Hennessy Louis Vuitton SE's P/E Ratio trends, charts, and more.Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 30.1 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 27.6038.At the end of 2021 the company had a P/E ratio of 30.1.

In depth view into Lvmh Moet Hennessy Louis Vuitton Operating PE Ratio including historical data from 2008, charts and stats. Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 131.70 -0.89 ( -0.67% ) USD | OTCM | Nov 01, 16:00 Pe Ratio (TTM) is a widely used stock evaluation measure. Find the latest Pe Ratio (TTM) for LVMH Moet Hennessy Louis Vuitton (LVMUY)Metrics similar to P/E Ratio (Fwd) in the valuation category include:. 10 Year Price Total Return - The total change in price (adjusted of dividends and splits when applicable) over the last 10 years.; 3 Month Price Total Return - The total change in price (adjusted of dividends and splits when applicable) over the last 3 months.; P/E Ratio (Fwd) - Indicates the multiple of forward .

lvmh stock forecast

About LVMUY. LVMH Moët Hennessy - Louis Vuitton, Société Européenne operates as a luxury goods company worldwide. The company offers wines, and spirits under the domaine des Lambrays, Château d'Yquem, Dom Pérignon, Ruinart, Moët & Chandon, Hennessy, Veuve Clicquot, Château Galoupet, Ardbeg, Château Cheval Blanc, Glenmorangie, Krug, Mercier, .

This LVMH page provides a table containing critical financial ratios such as P/E Ratio, EPS, ROI, and others. Investing.com - Financial Markets Worldwide Open in App

View LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) current and estimated P/E ratio data provided by Seeking Alpha.

The p/e ratio for LVMH Moet Hennessy Louis Vuitton (LVMHF) stock is 22.56 as of Wednesday, October 30 2024. It's improved by -6.58% from its 12-month average of 24.15. LVMHF's forward pe ratio is 21.46. The p/e ratio is calculated by taking the latest closing price and dividing it by the diluted eps for the past 12 months.Detailed statistics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) stock, including valuation metrics, financial numbers, share information and more. Financial ratios and metrics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (EPA: MC). Includes annual, quarterly and trailing numbers with full history and charts.

Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 29.6 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 26.4076.At the end of 2021 the company had a P/E ratio of 29.6.What is the difference between the current PE ratio and 20 year average for LVMH Moet Hennessy Louis Vuitton SE (LVMHF)? The current price to earnings ratio for LVMHF is -10.50% vs the 20 year average.

In depth view into Lvmh Moet Hennessy Louis Vuitton PE Ratio (Forward) including historical data from 2008, charts and stats. Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 136.18 -1.15 ( -0.84% ) USD | OTCM | Oct 29, 16:00

mt5400 vs rolex

Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 29.8 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 27.885.At the end of 2021 the company had a P/E ratio of 29.8.Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with numerous stakeholders that address important social issues.

In contrast to LVMH's PE ratio, peers such as Hermes (OTCPK:HESAF), Estee Lauder , and Moncler (OTCPK:MONRF) have an average P/E ratio of 49.58x, representing a substantial premium of 83.9%.

Find out all the key statistics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (MC.PA), including valuation measures, fiscal year financial statistics, trading record, share .LVMH Moët Hennessy - Louis Vuitton Société Européenne's latest twelve months p/e ratio is 26.3x.. View LVMH Moët Hennessy - Louis Vuitton, Société Européenne's P/E Ratio trends, charts, and more.LVMH is currently trading at a PE Ratio of ~22. This seems cheap at first glance compared to the 10-year historical ratio of 27, but if we factor out the unusually high ratios from early 2020 to .

41 talking about this

lvmh p/e|lvmh moët hennessy